Prices Continue to Show Improvement

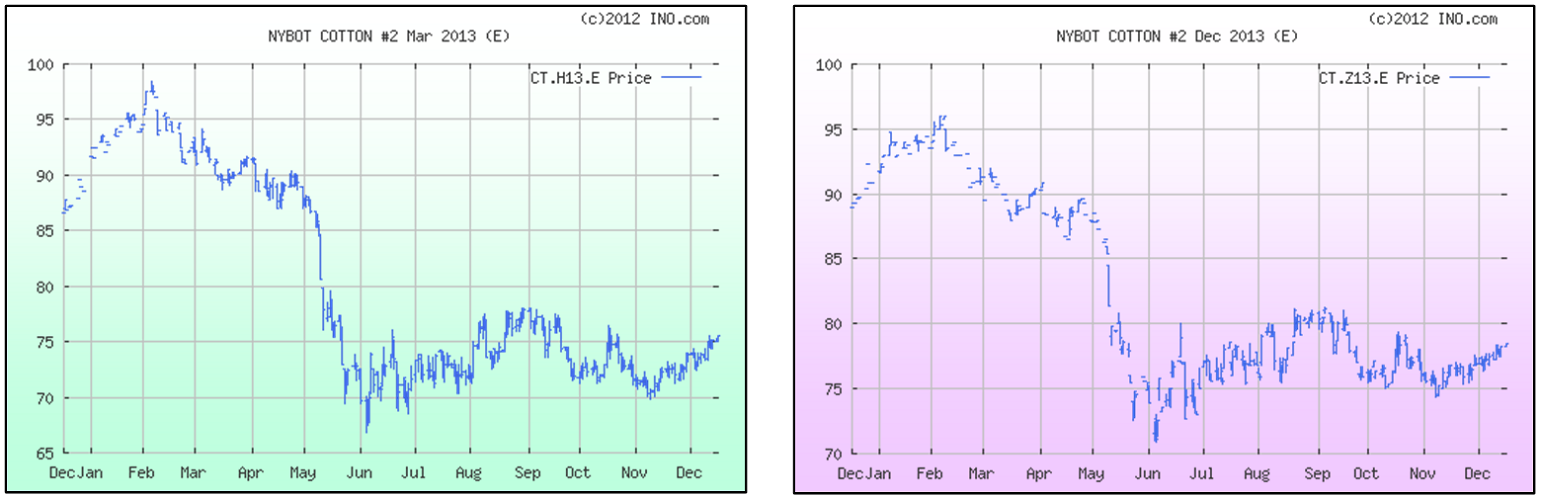

Since the most recent low back in early November, futures prices for both 2012 and 2013 cotton continue to trend upward. March futures closed today at just over 75 cents for the second time this week. Prices gained 2 cents for the week. New crop Dec13 futures closed today at over 78 cents and have gained over 3 cents since early November.

Although supply/demand is still overshadowed by large and burdensome World stocks, these are encouraging and opportunistic signs. In the near-term, old crop futures will likely to be bound by an area between 70 and 78 cents. We can add about a nickel to that and say that new crop, in the near-term, is likely bound between 75 cents and the low 80’s. Longer-term, the outlook is framed by (1) whether or not demand can improve and (2) by how much acreage and production is curtailed in 2013.

It is important to realize, however, that even with beneficial signs in these areas; any improvement in prices is going to be tempered by the very large level of World stocks. For remaining 2012 crop, prices in the upper portion of the range mentioned represent decision opportunities. For 2013 crop, an acreage decline is in order and the market already anticipates this. Prices moving too high too early will deter this. So, don’t expect too much. Prices at 80 cents or better represent a realistic starting point.

USDA’s December numbers were market-positive and provide price support. The US crop was trimmed 200K bales. Texas yield was lowered from the November estimate. This has been anticipated and it was just a matter of when it would show up. Also, US exports were raised 200K bales. World production for 2012 was raised slightly but World use (demand) was raised 150K bales. That’s not much but it’s the first monthly uptick in a long time. Also, World 2012 crop year ending stocks were lowered 630K bales—back down below 80 million bales. Again, the first time stocks have been adjusted downward in a long time.

The outlook seems to be improved and the uptrend we’ve been in for the past 6 weeks is encouraging. There is already preliminary talk of 90-cent cotton. I don’t see it. Let’s not lose focus of the key drivers—how will China manage its reserves (47% of all World stocks), demand (are we finally seeing some positive signs), and 2013 World production (acreage will be down but weather is always a big unknown).

Don Shurley

University of Georgia