Cotton Heads South to the Danger Zone

Click here to download Volume 10, Number 23 (November 2, 2012) of the Cotton Market News. The newsletter is sponsored by Southern Cotton Growers, Inc.

Two weeks ago, bullish buying had stimulated the market—pushing cotton (Dec12 futures) to the 78-cent level and the highest levels since May. Well, that didn’t last long and now, a new negativity seems to have taken over.

The December contract (its use by merchants for pricing cotton spot sales), is running out of time and prices will switch to basis the March futures within the next 10 days to 2 weeks. Today, Dec12 is flirting dangerously with dropping below the 70-cent level but so far has held. Mar13 is at 71 and change. Dec12 has not closed below 70 since June.

Since closing at near 78 cents on Oct 17, cotton has dropped roughly 7½ cents. After big losses, prices tried to stabilize at the 72 to 73-cent area last week but couldn’t hold and we’ve lost another 2½ cents since then. There is currently little new fundamental supply-demand news to impact the market. Having said that, bearish technical signals could take us to the 65-cent area unless fresh buying interest kicks in. In the past, the 70-cent area has generated buying support and we can hope that happens this time as well.

This most recent decline is no doubt concerning to growers with the majority of their crop still left to price. At this point, I believe the only thing to do is hold. Of course it’s risky, but I have to believe that remaining downside price movement is probably limited and it’s worth the risky to wait for some type of recovery.

USDA’s November production and supply-demand numbers will be released next Friday, November 9th. Pre-report opinions circulating suggest that already burdensome and record World stocks may increase further due to continued weak demand. However, there is also some belief that the US crop could decline (although it could be the December report before fully showing up). Reports suggest that harvest in Texas could decline as marginal fields are mowed down rather than picked. But, could this result in a higher average yield overall? Just wondering. It’s also worth mentioning that recent temperatures here in GA have been below average and may impact (halt) further boll development and opening on later planted cotton. As a result, the GA cotton yield could end up less than expected unless offset by better yields on the remaining crop. Again, just an observation worth noting.

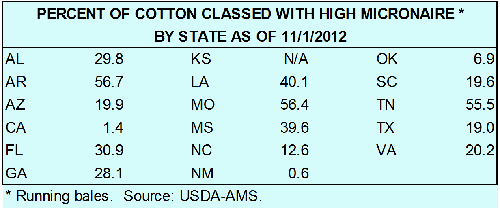

Approximately 35% of the US crop has been classed as of yesterday. High mike has been a major problem with the crop. Some states are showing over 50% of the crop going high in micronaire (5.0 and higher). With large World supply and stocks to choose from, this could present a challenge for US exports to meet foreign mill quality demands.

Don Shurley

University of Georgia

donshur@uga.edu

229-386-3512